The best payroll services for small businesses

As your small business grows, you’ll start hiring employees and running payroll. Payroll refers to the total amount paid to employees and the process of calculating pay and issuing paychecks. The process can be time-consuming, but a payroll service helps automate payroll and simplify tax filing, ensuring you run payroll correctly and efficiently. Keep reading to learn how payroll services streamline the payroll process for your small business and tips for choosing the best platform for your company.

Payroll processing stages

The basic steps involved in running payroll include:

- Deciding a pay cycle: Determine how frequently you will pay your employees, such as weekly, biweekly, or monthly.

- Collect employee information and tax documents: Ask each employee to fill out a W-4 form, state withholding tax form, and direct deposit information.

- Calculate gross pay: Gross pay is the amount a team member earns before taxes, benefits, and other deductions.

- Calculate net pay: Subtract taxes and other deductions from the employee’s gross pay to determine their net pay.

- Initiate payment: If you’re paying your team by check, write and distribute checks to your workers. If you’re paying by direct deposit, initiate the payment to transfer the funds from your business bank account to each employee’s bank account.

- Pay taxes: Pay payroll taxes to the appropriate federal and state agencies and file payroll tax forms.

How to process payroll

Generally, there are three ways to process payroll:

- Manually: Use a spreadsheet or other solution to calculate payroll taxes and other deductions. Running payroll manually takes time and increases the chances of errors.

- Outsourcing: You may hire a bookkeeper or certified public accountant (CPA) to process payroll.

- Payroll software: Payroll software providers, like Gusto or ADP, gather all the essential information for you, calculate required tax withholdings, and initiate payments to your employees. These services can be an easy and cost-effective way to simplify payroll processing without outsourcing it.

How does a payroll service work?

A payroll service is either software that allows you to process payroll yourself or an outsourced provider that handles payroll.

Most payroll services will work similarly:

- You will enter wage and benefits information into the system for each team member. You will also include each employee’s W-4 form, state withholding information, and banking information (if paid by direct deposit). Many service providers offer an employee portal allowing your workers to input most of this information.

- You will run payroll a few days before payday to ensure your staff is paid on time. The payroll service will calculate tax withholdings and deductions to determine each employee’s net pay.

- The platform will then initiate a direct deposit or allow you to write or print paychecks.

Benefits of using payroll services

Payroll services simplify payroll by doing most of the work for you, allowing you to focus on running your small business. Additional benefits of using a payroll service include:

- Ensured tax compliance: Many payroll services handle tax filings and payments.

- Reduced expenses: Running accurate payroll can help you cut costs by eliminating mistakes.

- Reliable processing: Payroll services will run payroll automatically or remind you to run payroll to ensure your employees are paid accurately and on time.

Top payroll services for small businesses

We’ve compiled a list of top payroll platforms to help you select the right service.

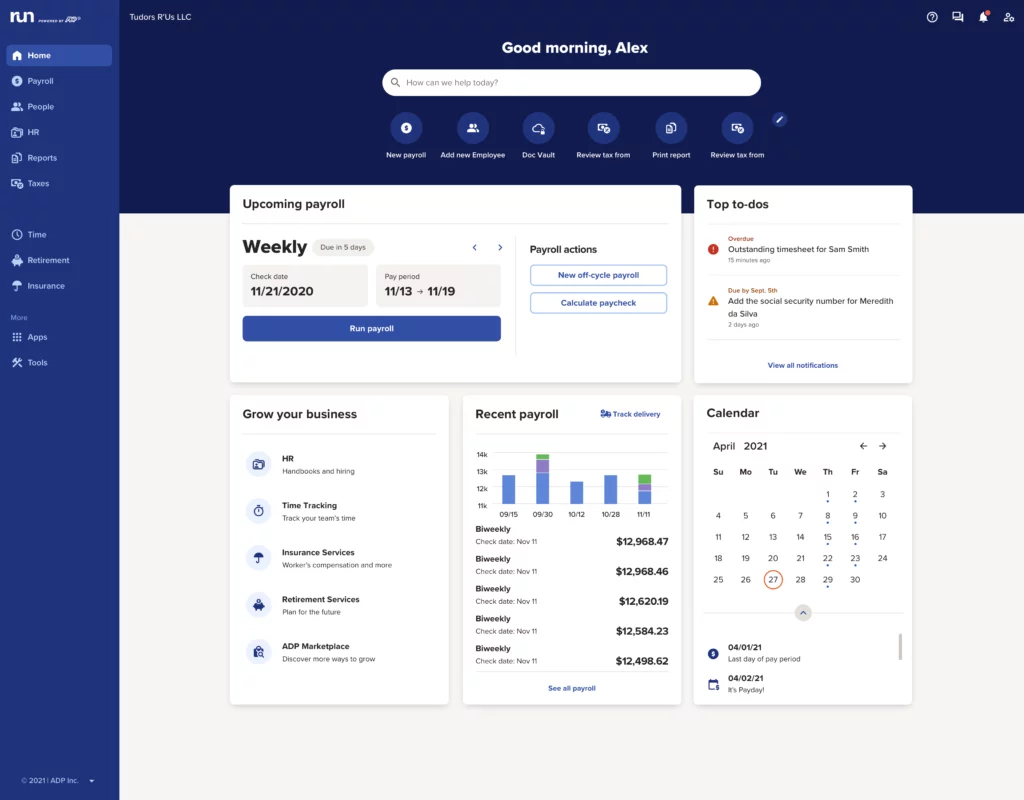

1. ADP

ADP provides a range of payroll services for businesses of all sizes.

Key features

- Full-service payroll: Process payroll in minutes or set it to run automatically.

- Tax filing: ADP will remit and file payroll taxes.

- Employee self-service: Employees can access their pay stubs and tax forms online.

Pricing

Contact ADP for pricing information. ADP offers multiple packages for RUN, its small business platform:

- Essential: This package includes payroll, tax filing, and more. You can also purchase add-on features, like time and attendance, retirement benefits, workers’ compensation, and health insurance.

- Enhanced: You’ll have everything in Essential plus state unemployment insurance, labor law poster compliance, ZipRecruiter, and more.

- Complete: With this plan, access everything in Enhanced and an employee handbook wizard, HR tracking, HR forms, and more.

- HR Pro: HR Pro includes everything in Complete plus an applicant tracking system, enhanced employee handbook support, employer and employee training, and more.

Customer reviews

- G2: 4.5/5 (1,100+ reviews)

- Capterra: 4.5/5 (745+ reviews)

2. BambooHR

BambooHR allows you to add payroll to your HR subscription.

Key features

- Payroll: You can quickly run payroll in just three steps.

- Automatic tax payments: BambooHr handles all federal, state, and local payroll taxes.

- Employee self-service: Employees can access their pay stubs and direct deposit information online.

Pricing

Contact BambooHR for pricing information.

Customer reviews

- G2: 4.5/5 (1,275+ reviews)

- Capterra: 4.6/5 (2,295+ reviews)

3.Gusto

Gusto offers full-service payroll at a reasonable price.

Key features

- Full-service payroll: You can run payroll as many times as you want each month. You can also set payroll to run automatically.

- Automatic tax filing: Gusto will file and remit payroll taxes with the correct government agencies.

- Benefits management: With Gusto, you can offer benefits like health insurance, dental and vision insurance, and retirement funds.

Pricing

Gusto offers multiple plans:

- Simple: Payroll for a single state is $40/month plus $6/month per worker. This plan includes employee self-service, basic hiring and onboarding tools, health insurance administration, employee financial benefits, and more.

- Plus: This plan costs $80/month plus $12/month per worker. You’ll get everything in Simple plus payroll for multiple states, next-day direct deposit, advanced hiring and onboarding tools, paid time off (PTO) management, time tracking, and more.

- Premium: The plan includes everything in Plus and compliance alerts, access to certified HR experts, performance reviews, and more. Contact Gusto for pricing information.

- Contractor Only: This plan is for companies hiring only independent contractors. For the first six months, you will pay $6/month per worker. Then, you will pay $35/month plus $6/month per worker. You’ll have unlimited contractor payments across all 50 states, a four-day direct deposit, and 1099-NECs at the end of the year.

Customer reviews

- G2: 4.1/5 (680+ reviews)

- Capterra: 4.6/5 (3,690+ reviews)

4. Heartland

Heartland offers a payroll service designed to scale your business.

Key features

- Payroll: Process payroll online to ensure your team is paid accurately and on time.

- Automatic payroll taxes: Heartland offers a variety of tax reporting capabilities to help you stay compliant.

- Benefits administration: Heartland allows you to sync benefit-related payroll deductions with each payroll run.

Pricing

Contact Heartland for pricing information, but prices start at $89/month. The plans offered include:

- Essentials: This plan includes payroll, payroll taxes, new hire reporting, onboarding, employment verification, and more.

- Advanced: With the Advanced package, you’ll gain everything in Essentials plus job postings, candidate screenings, and applicant tracking.

- Complete: This plan offers everything in Advanced plus HR tracking, an employee handbook builder, job descriptions, and more.

Customer reviews

- G2: 4.4/5 (125+ reviews)

- Capterra: 3.2/5 (6 reviews)

5. Insperity

Insperity is an HR platform that can include payroll.

Key features

- Payroll: Pay your employees quickly via direct deposit, check, or payroll debit card.

- Payroll taxes: Insperity tracks payroll taxes withheld and remitted to help you file tax forms more easily.

- Time and attendance: Insperity’s time-tracking system integrates with each payroll run to simplify the process.

Pricing

Contact Insperity for pricing information.

Customer reviews

- G2: 3.8/5 (29 reviews)

- Capterra: 5/5 (6 reviews)

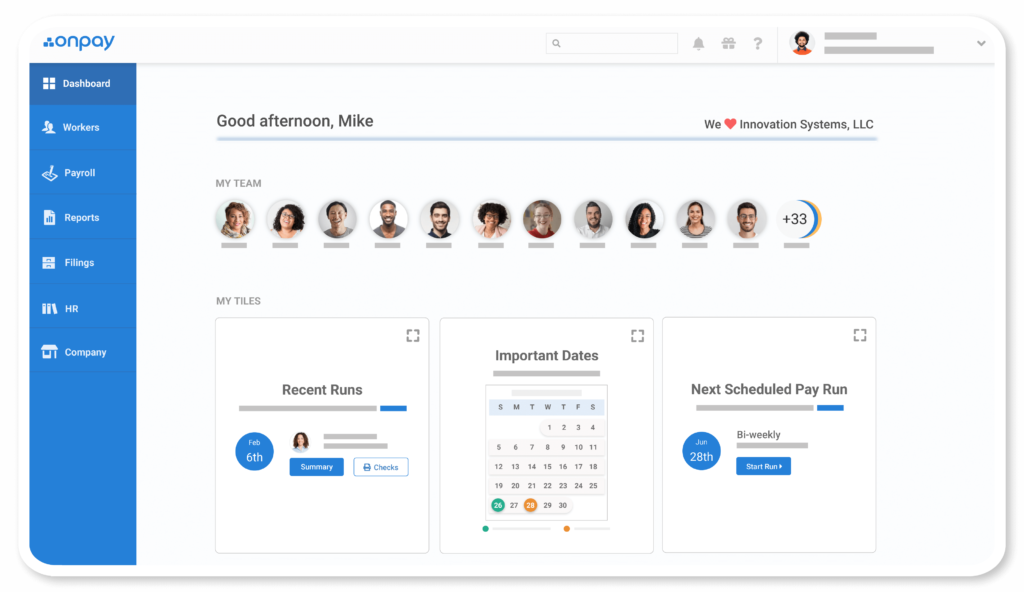

6. OnPay

OnPay is an all-in-one payroll and HR solution for small businesses.

Key features

- Payroll: Run unlimited payroll for W-2 employees and independent contractors.

- Automatic payroll taxes: OnPay handles federal and state payroll taxes.

- Multiple pay rates and schedules: You can have multiple pay schedules and set different pay rates for each employee.

Pricing

The first month of OnPay is free. After the first month, you’ll pay $40/month plus $6/month per person.

Customer reviews

- G2: 4.8/5 (230+ reviews)

- Capterra: 4.8/5 (410+ reviews)

7. Patriot

Patriot offers payroll plans that integrate with their accounting and time-tracking platforms.

Key features

- Payroll: Pay W-2 employees and independent contractors at any pay frequency.

- Time-off accruals: Set up and customize your PTO policy to have time-off hours automatically added to each payroll run.

- Automatic payroll taxes: Patriot handles federal, state, and local payroll taxes.

Pricing

Patriot offers a 30-day free trial. Then, you can choose between two paid subscription plans:

- Basic payroll: For $37/month plus $4/month per worker, you’ll have a two-day direct deposit, employee portals, unlimited payrolls, and more.

- Full-service payroll: For $37/month plus $4/month per worker, you’ll gain access to everything in the basic plan, plus automatic payroll tax payments and filings.

Customer reviews

- G2: 4.8/5 (465+ reviews)

- Capterra: 4.8/5 (3,195+ reviews)

8. Paychex

Paychex is a cloud-based payroll service that offers plans for businesses of all sizes.

Key features

- Payroll: Pay employees by direct deposit, check, or pay card.

- Payroll taxes: Paychex manages payroll taxes, including quarterly and year-end filings.

- Employee self-service: Your employees can enter their W-4 form, state withholding form, and direct deposit information online.

Pricing

Paychex offers several plans:

- Essentials: For $39/month plus $5/month per employee, you’ll have direct deposit, employee self-service, new-hire reporting, and more.

- Select: This plan includes everything in Essentials plus additional employee payment options and onboarding. Contact Paychex for pricing information.

- Pro: Pro includes everything in Select plus state unemployment insurance, employee screening essentials, and an employee handbook builder. Contact Paychex for pricing information.

Customer reviews

- G2: 4.2/5 (1,435+ reviews)

- Capterra: 4.1/5 (1,360+ reviews)

9. QuickBooks

QuickBooks offers payroll services that scale with your small business and integrate with their accounting software.

Key features

- Payroll: Run payroll easily as needed or set it to run automatically.

- Automatic payroll taxes: QuickBooks calculates, files, and pays payroll taxes.

- Tax penalty protection: QuickBooks will pay up to $25,000 if you receive a payroll tax penalty while using their product.

Pricing

QuickBooks offers a 30-day free trial. You can waive the free trial for 50 percent off a paid subscription. Packages include:

- Core: For $45/month plus $5/employee per month, you’ll gain access to full-service payroll, 1099-MISC and 1099-NEC forms, next-day direct deposit, and more.

- Premium: Premium costs $75/month plus $8/employee per month. You’ll have everything in the Core plan plus same-day direct deposit, time tracking, and more.

- Elite: For $125/month plus $10/employee per month, you’ll gain access to everything in Premium plus project management, tax penalty protection, and a personal HR advisor.

QuickBooks also allows you to bundle payroll and bookkeeping.

Customer reviews

- G2: 3.6/5 (40+ reviews)

- Capterra: 4.5/5 (790+ reviews)

10. Rippling

Rippling is a user-friendly payroll service that allows you to run payroll in as little as 90 seconds.

Key features

- Payroll: Rippling can sync all your HR data with payroll, so you can quickly process payroll.

- Automatic tax filing: Rippling calculates and files federal, state, and local payroll taxes.

- Integration: Sync payroll with Rippling’s suite of products, including time and attendance, expense management, and benefits administration.

Pricing

Contact Rippling for specific pricing information, but their pricing starts at $8/month per user.

Customer reviews

- G2: 4.8/5 (1,815+ reviews)

- Capterra: 4.9/5 (2,430+ reviews)

11. Square

Square is a well-known payment processing software that now offers an easy-to-use payroll platform.

Key features

- Payroll: Square makes paying W-2 employees and independent contractors easy.

- Automatic payroll taxes: Square will pay and file payroll taxes.

- Integrations: Seamlessly sync payroll with Square’s suite of products, including Square Team Management and Square POS.

Pricing

Square offers two paid payroll plans:

- Employee & contractors: For $35/month plus $5/month per worker, you’ll gain access to full-service payroll, automatic payroll taxes, timecards, tips and commissions tracking, and more.

- Contractors only: If you only pay independent contractors, you’ll pay just $5/month per worker.

Customer reviews

- G2: 4.2/5 (28 reviews)

- Capterra: 4.7/5 (595+ reviews)

12. SurePayroll

SurePayroll is a straightforward option that offers payroll and HR for small businesses.

Key features

- Auto payroll: If you have the same payroll each pay period, set payroll to run automatically.

- Tax filing: SurePayroll will pay and file your taxes for you and help resolve mistakes if you receive a notice.

- Integrations: Integrate payroll with other software, including QuickBooks, Xero, and BuddyPunch.

Pricing

SurePayroll offers two paid subscription plans:

- No Tax Filing: For $19.99/month plus $4/month per employee, you’ll have a two-day direct deposit, payroll tax calculations, unlimited payroll runs, auto payroll, and online pay stubs.

- Full-Service: For $29.99/month plus $5/month per employee, SurePayroll will file and deposit federal, state, and local taxes.

SurePayroll also offers a package for household employees, like nannies, for $49.99/month, including one employee; each additional employee is $10/month.

Customer reviews

- G2: 4.4/5 (500+ reviews)

- Capterra: 4.1/5 (225+ reviews)

13. Wave

Wave is a user-friendly payroll platform catering to small businesses unique needs.

Key features

- Payroll: Wave allows you to pay W-2 employees and independent contractors easily.

- Automatic payroll taxes: Wave automatically pays and files state and federal payroll taxes for specific states.

- Employee self-service: Team members can access their pay stubs and W-2s and manage their contact and banking information online.

Pricing

Wave offers a 30-day free trial. Then the cost depends on whether Wave will handle payroll taxes.

- Tax service states: For $40/month plus $6/month per worker, Wave will automatically pay and file payroll taxes for the following states: Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin.

- Self-service states: For $20/month plus $6/month per worker, Wave will let you know how much to remit in payroll taxes, but you must handle them yourself.

Customer reviews

- G2: 4.1/5 (29 reviews)

- Capterra: 4.0/5 (60+ reviews)

Using a CPA firm

Instead of processing payroll in-house, you can hire a CPA firm to handle everything. CPA firms will typically run payroll and handle payroll taxes with minimal input from you.

Pricing

Contact CPAs in your area to learn more about their pricing, but you can often expect to pay a CPA firm by the hour for payroll processing.

How to choose the right payroll service

To help you select the best payroll provider for your small business, consider the following:

- Features: Ensure that the payroll service you choose includes all the features your business needs, such as direct deposit, automatic payroll taxes, employee self-service, and integration with an accounting platform.

- Business size: When comparing payroll providers, consider how many employees you currently have and how many more you plan to add in the next few years. Ideally, you’ll choose a payroll service that meets your needs now and in the future.

- Budget: Budget is a critical factor when making any business purchase decision. When shopping for a payroll provider, consider the base subscription fee, the per-employee fee, and any extra costs for add-on features you’d like to use.

- Types of workers: You may hire both W-2 employees and independent contractors, and your payroll service must be able to handle each type of worker you employ.

Can your payroll service provider handle payroll taxes?

You must pay your team members accurately and stay compliant with payroll tax regulations, including withholding and remitting federal and state income taxes and Social Security and Medicare taxes. Your payroll service will typically handle these for you, but read “How much are payroll taxes and how are they calculated?” to learn more.