When you hear the phrase “estate planning,” you may imagine it only applies to the wealthy. People who own mansions, sprawling properties, and multi-million dollar businesses. Wrong! Even if your net worth is closer to four digits than to seven, estate planning should be taken seriously.

It sounds complicated, and it certainly can be. This guide will explain everything you need to know about how to get started planning your estate. It will help you strategize your estate planning to benefit yourself and your heirs.

What is estate planning?

Estate planning is about planning what happens to you and your property over the long term. The plan involves more than what happens to your assets or property if you die. It also involves planning around who makes financial and medical decisions on your behalf if the following events occur. If you become incapacitated, your preferences for these decisions, and who takes care of your pets or children if you should die or become incapacitated.

Estate planning involves multiple documents and decisions. It’s your property, and you should be the one who ultimately gets to decide what happens to it. But if you neglect to make those decisions before dying, your assets may be tied up in probate for months or even years, dwindling away from taxes and legal fees before your heirs can access the assets.

Importance of estate planning

Planning your estate will give you peace of mind because it ensures that the executor of your estate follows your wishes and that beneficiaries provide care for your loved ones.

If you decide to ignore estate planning, you leave your loved ones to guess at what your wishes may have been at the same time they are grieving your loss. You may even inadvertently cause family disputes if people disagree about what your wishes would have been.

Moreover, your state’s intestacy laws (laws applicable to individuals who die without a will) will apply to your assets, meaning your wishes will not be a factor. While the state is busy putting all your estate through probate, any wealth you have attained will erode due to attorney fees, court fees, and taxes.

Your wealth, even if not much, should be a blessing to your loved ones, but failing to plan for it and make your wishes known can cause irreparable family rifts. Since estate planning also involves end-of-life decisions, it’s a relief for your loved ones to follow your directions rather than trying to guess what you would want.

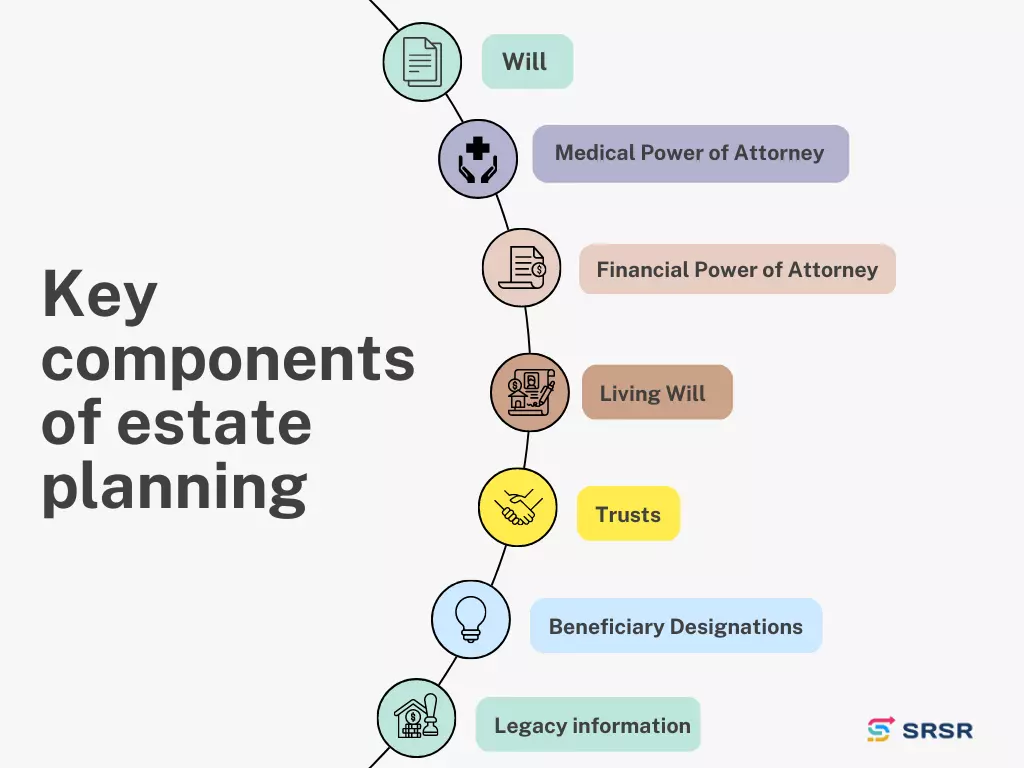

Key components of estate planning

A comprehensive estate plan involves several documents. Each has its purpose, and they all work together to form a complete picture of your wishes if you should pass away or become incapacitated. Here is a list of documents your estate plan should include, what each one does, and why it’s important.

Will

Your will is the most apparent document involved in estate planning. Again, you don’t need to have a lot of assets to have a will. Your will tells everyone you leave behind what should happen with your assets. Even if you don’t have much money, it can also designate who should become your children’s or dog’s guardian. Simply having a will keeps your family from spending a lot of time in probate, saving both time and money. Your will also names an executor responsible for carrying out everything in your will.

It’s essential to ensure that your will meets your state’s standards of a legal will. You may be able to write it yourself or use an online form. However, an attorney can help you create your will that can help ensure it meets your state’s requirements.

Medical Power of Attorney

It’s not very fun to think about needing this document, but part of your estate planning means preparing for anything that could happen. Your medical power of attorney (POA) designates someone else to make medical decisions if you cannot. Suppose you are in a serious accident and can no longer make decisions about your medical care. In that case, the person you designate with this document can make medical decisions on your behalf.

Without this document, state law may grant your medical power of attorney to someone who you’d prefer not to have it. Having a medical POA ensures that only the person you designate can make decisions on your behalf.

Financial Power of Attorney

Similar to the medical POA, a financial POA grants financial power to the person you designate if you should become incapacitated. This person can then access your checking and savings accounts, buy or sell property, and make other financial decisions on your behalf.

Again, even though you hope you never need this document, it’s crucial to complete it so that only the person you want to be in charge of your finances can access them.

Living Will

Your living will also is called a health care directive. This document outlines your wishes for your end-of-life treatment. It tells your family and your medical providers what type of care you’d like to receive if you should become incapacitated. For example, it may tell doctors if you would like to be resuscitated or if heroic measures should be taken to sustain your life when you are terminally ill.

This document gives your family and loved ones peace of mind. They’ll know that they’re following your wishes if there comes a time when you can’t make medical decisions for yourself.

Trusts

Trusts are arrangements that allow a trustee to manage assets on behalf of a beneficiary after they pass. For example, your trustee can manage the finances on behalf of your minor children to continue providing support for them. Your estate plan may or may not need a trust. A few of the more common types of trusts are marital trusts, charitable trusts, and testamentary trusts.

Trusts can help reduce or eliminate taxes. They also allow assets to pass without going to probate, which can save both time and money. These can be complicated to set up properly. An estate planning attorney can help you decide if you need one and how it ought to be set up.

Beneficiary Designations

If you have a life insurance policy, retirement fund, pension, or other assets, they can pass directly to your beneficiary. While you’re working on estate planning, be sure to update your beneficiary designations. Choose at least one primary beneficiary and one secondary beneficiary in case the primary beneficiary passes before you do.

Legacy information

This isn’t a document, but it can make it quicker and easier for your survivors to manage your estate. You can make the executor of your will’s job significantly easier if you keep all your important documents together. Your life insurance policies, a list of your bank accounts, vehicle titles, retirement accounts, and information about any other assets should be kept in a place where your survivors can find them.

Benefits of estate planning

Estate planning doesn’t just benefit you. It also benefits your family, your friends, and your heirs in multiple ways.

Keeps your family out of court

If you don’t designate a medical POA or a financial POA, the court will designate one for you. However, they may not pick the person (or people) you would have chosen. What’s even worse, the court will continue to supervise the person they chose, to make sure they are acting in your best interest. This takes a lot of time and costs money, and guess who pays the bill? It’s you!

Ensuring your beneficiaries are up to date, creating a trust, and planning your estate properly can also help your loved ones avoid spending time in court.

Ensures your loved ones will be cared for

If you die without a will, your state’s laws will dictate where your money goes. For example, if you have children from a previous marriage, your spouse may only get some of your estates while your children get the rest, even if they’re adults and your spouse needs the money to survive. Or, if you have a stepchild, the state may entirely skip them when they are passing out your money, even if you’d like them to be treated the same as your other children.

If you have minor children, the state will also have to choose a guardian for them. Families can be complicated, and the best way to make sure that your loved ones are cared for is to make an estate plan.

Distributes your estate more efficiently

A clear will and estate plan will simplify the transfer of your assets. Your heirs will benefit by not having to wait for decisions from the court. Your money will go to the people you want to have it, and they can access it much more easily.

Reduces taxes

Estate taxes are no joke. The federal government charges estate taxes upon your death if your estate is above a certain size, and some states have estate taxes as well. Planning by creating trusts can keep more of your money in your heirs’ hands instead of in the government’s, particularly if you have a large estate.

Strategies for estate planning

Planning your estate is a lot of work initially, but the peace of mind and benefits of estate planning will make it well worth it. Here’s how to get started.

- Gather a list of your assets – What assets do you have? Think about the physical property such as your home, vehicles, collectibles, and other possessions. Also consider any place you have money, like checking or savings accounts, stocks, retirement accounts, health savings accounts, or any business you own (either in full or in part).

- Make beneficiary choices – Decide on the people you’d like to receive your assets. Be sure to update the designations on life insurance policies, bank accounts, brokerage accounts, and any other account with a beneficiary.

- Consider your family’s needs – Consider whether you need to continue providing for someone like a minor child or a spouse after your death. You may need to set up a trust so your estate can continue caring for those who rely on you for support.

- Seek a trusted estate planning attorney – Your attorney can help you discover the best options for your situation, including how to avoid taxes, how to care for your loved ones, and how your specific assets may be affected by state or federal laws.

- Make sure all your documents are legally valid – Your will and any POAs or other documents may need to have a witness and/or be notarized to be legally valid. Your attorney can help you make sure all these documents are completed correctly.

Difference between estate planning and creating a will

Your will is the most important document for distributing your assets to your heirs and you can name a guardian for your minor child(ren). It also names the executor of your estate. A will is an important part of estate planning, but estate planning involves a lot more than just a will.

There are a lot of other things to consider in your estate planning, and this includes provisions that may go into place while you’re still living. Your will doesn’t take effect until you pass, while your estate plan can take effect when you begin putting assets into a trust or if a POA needs to be used.

Final thoughts on effective estate planning

While it’s great to do the initial estate planning, you should also plan to revisit your estate planning documents regularly. Major life events like marriage or divorce; the birth, death, or adoption of a child; or even moving to another state can all impact the way your estate planning documents are written. You may wish to review and change beneficiaries and your POAs. You can also add assets to your plan as you acquire them.

Estate planning is an ongoing process, and you may need to update your documents multiple times over your lifetime.

Wills and trusts are both important parts of your estate planning. To learn more about the differences between these two documents and how you can use both of them in your estate planning, check out our article explaining Trusts vs. Wills.