It’s crucial that small business owners understand their company’s finances. Financial statements can help you do that. Several types of financial statements work together to give you a complete picture of your business’s financial health.

In this article, we’ll share more about financial statements, including the four most important types you need to prepare for your company.

What is a financial statement?

A financial statement is a written record of your company’s financial performance and business activities. However, you cannot get the complete picture from just one document. You need multiple types of financial statements to truly gain insight into your business’s finances.

Each type of financial statement will provide an in-depth look at a particular facet of your company’s financial health. All these documents work together to show you where the company’s money comes from, how it is spent, and where that money is now.

Importance of financial statements

Financial statements are used by the business owner, investors, market analysts, auditors, and creditors to evaluate your company’s financial health and profitability. They show how your business generates revenue and how efficiently the company manages its money.

You can analyze financial statements for a single reporting period or compare them to previous periods. Comparing financial statements can help you determine whether your company’s financial health is improving over time. You can also compare your financial records to other companies’ documentation to see how your business is doing compared to others in the industry.

You can use these comparisons to help you make better business decisions. By utilizing your financial statements, you’ll know where you should invest, how to best use your business capital, and what expenses need to be reduced.

If you’re seeking a loan for your business, you will need to produce clear and transparent financial statements. Lenders will use this documentation and your business credit score to determine if your company can repay a loan. If you don’t know your business credit score, read our article “How to check your business credit score.”

4 common types of financial statements

There are many different types of financial statements that a small business can prepare to comply with audits, apply for loans, or stay on top of its finances.

The four most crucial financial statements for small businesses are

- income statements,

- balance sheets,

- cash flow statements, and

- statements of owner’s equity.

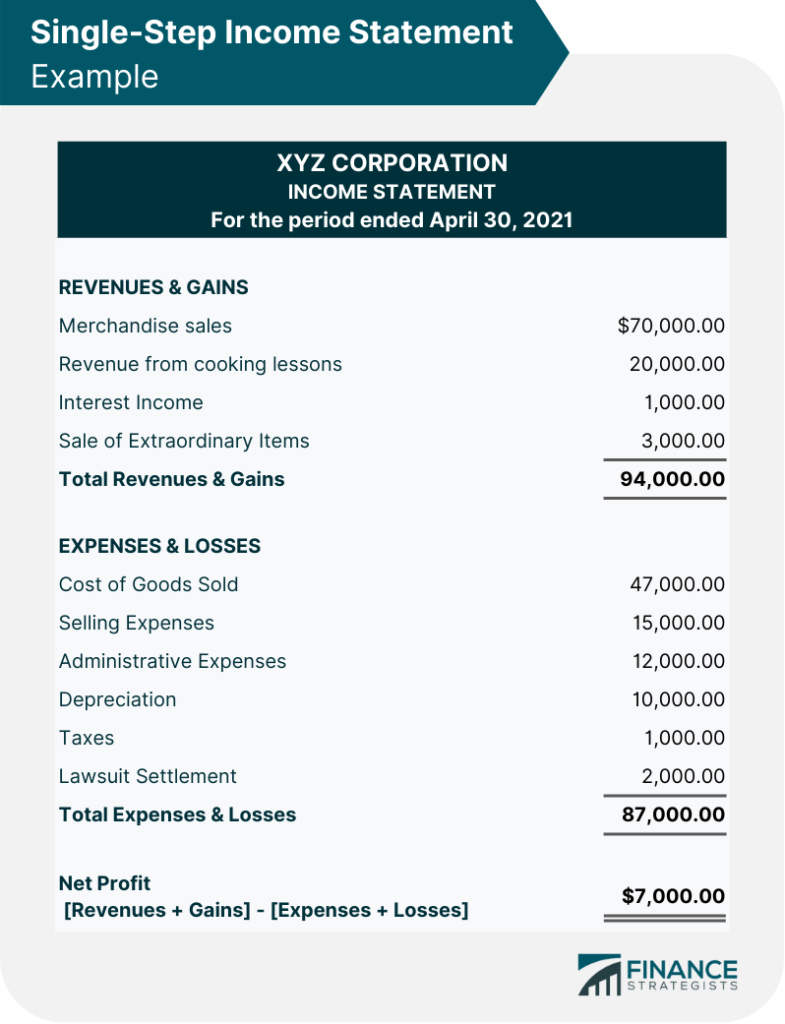

1. Income statement

An income statement, also known as a profit and loss (P&L) statement, is often considered the most important financial statement. It conveys your company’s income and expenses to show whether you turned a profit or suffered a loss over a range of time, such as a year or quarter.

Importance of an income statement

A P&L statement’s primary purpose is to depict whether your company is profitable and how well it is managing expenses. You can use the statement to determine how well various revenue streams are performing so you know which ones to continue pursuing. An income statement can also help you determine which costs to reduce in order to increase profitability.

What’s included in an income statement?

An income statement is separated by revenue and expenses. Each section is further broken down to ensure you fully understand your small business’s financial health.

The revenue portion will include operating, non-operating, and other revenue.

- Operating revenue: This is generated from your company’s core business activities, such as selling products or services.

- Non-operating revenue: This is income earned from activities outside your company’s primary function. Examples of non-operating revenue include interest earned on cash in a bank, royalty payments, and advertisements displayed on your business’s property.

- Other income: This is revenue earned from all other business activities and could include gains from the sale of a long-term asset, like land, vehicles, or equipment.

On your income statement, you’ll list your primary and typical expenses.

- Primary expenses: These expenses are incurred during the process of earning revenue from core business activities. Examples of primary expenses include the cost of goods sold, general and administrative costs, depreciation or amortization, and research and development.

- Typical expenses: These types of costs are ones most companies will incur during normal operations. Typical expenses may include employee wages, sales commissions, utilities, and loan interest.

After tracking your assets and expenses, you’ll determine your company’s net income by subtracting total expenses from total revenue.

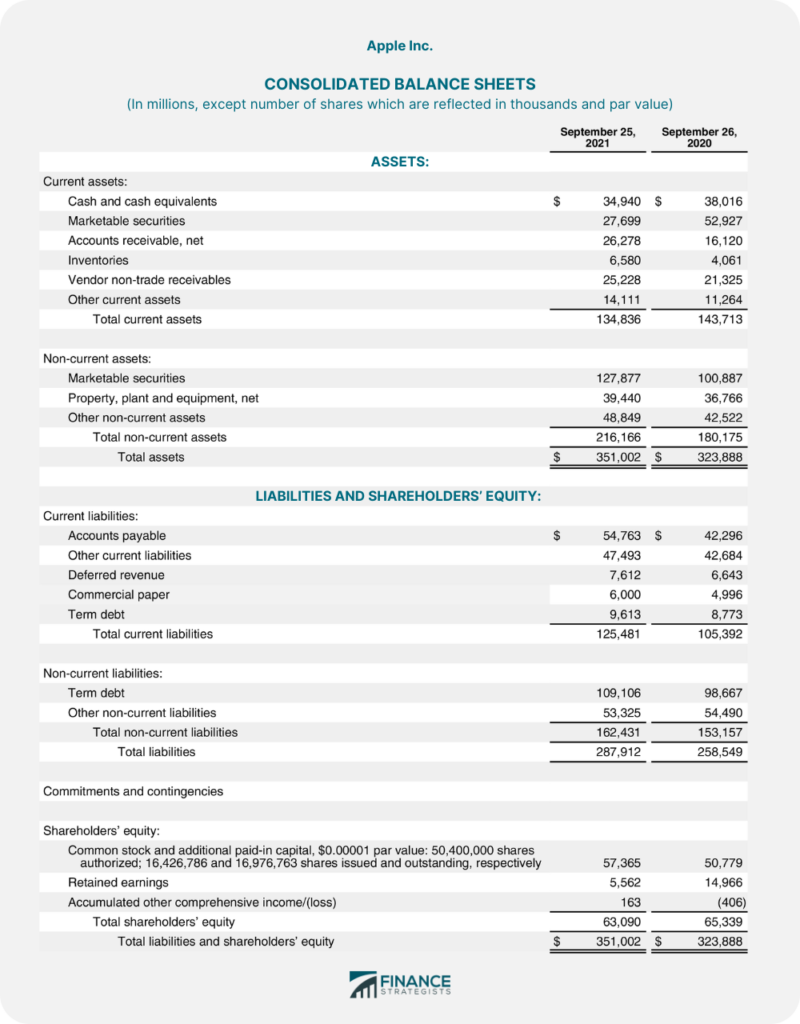

2. Balance sheet

A balance sheet displays your business’s assets, liabilities, and shareholders’ equity for a specific point in time, generally at the end of a reporting period.

Importance of a balance sheet

Because a balance sheet lists everything your company owns and all of its debt, you can use it to determine whether the business can meet its financial obligations. A balance sheet may also be crucial when you’re trying to secure funding because investors will use it to determine your business’s financial health.

What’s included in a balance sheet?

The assets portion of your balance sheet typically includes liquid assets, accounts receivable, inventory, prepaid expenses, capital assets, investments, and intangible assets.

- Liquid assets: This is any asset that can quickly and easily be converted into cash. Examples of liquid assets include cash, the company’s bank balance, treasury bills, and certificates of deposit.

- Accounts receivable: Accounts receivable are money customers owe to the business for the sale of products or services.

- Inventory: This is the goods the company has on hand to sell. Inventory may include finished products, works in progress, and raw materials.

- Prepaid expenses: These are costs that the business has paid in advance. You will record prepaid expenses as assets because you have not yet recognized their value

- Capital assets: Capital assets are owned by the company for its long-term benefit. Examples include property, manufacturing facilities, and equipment.

- Investments: These assets are held for speculative future growth and include stocks and bonds.

- Intangible assets: Intangible assets have theoretical future economic value for your small business, even though they cannot be physically touched. Examples include trademarks, patents, and goodwill.

Liabilities Section of the Balance Sheet

The liabilities section of your balance sheet includes accounts payable, current debt, current portion of long-term debt, and long-term debt.

- Accounts payable: These are bills due as part of the normal course of operations. Accounts payable include utilities, rent invoices, and obligations to buy raw materials.

- Current debt: Current debt is any debt due within one year.

- Current portion of long-term debt: This is the portion of long-term debt due within a year.

- Long-term debt: Long-term debt is due in its entirety in longer than one year. Examples include a mortgage or bank loan.

The final section of your balance sheet is the shareholders’ equity, which is the money ascribable to the owners or shareholders of a business. This section may also include retained earnings, which represents the total net income that the company has reinvested or used to pay off debt

On your balance sheet, the total assets will always equal the sum of your business’s liabilities and shareholders’ equity.

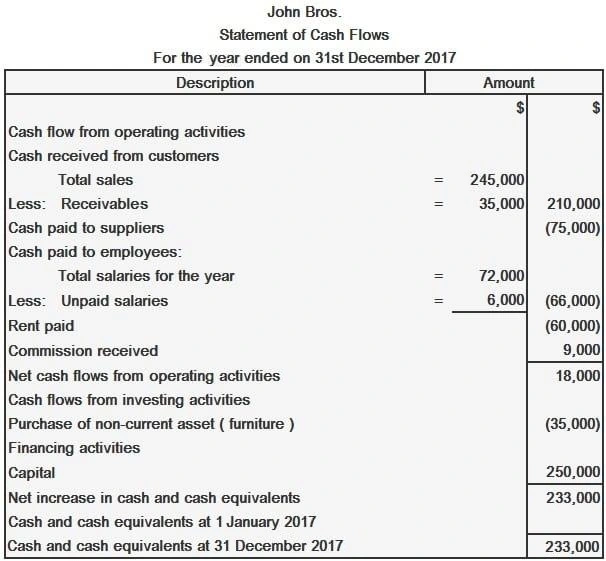

3. Cash flow statement

A cash flow statement depicts how money enters and leaves your company at a particular point in time through its various activities.

Importance of a cash flow statement

Your cash flow statement is vital for showing how quickly you can source cash if needed to pay debt obligations and fund operations.

What’s included in a cash flow statement?

You can break down a cash flow into three sections: operating activities, investing activities, and financing activities.

- Operating activities: These are activities that your business performs to bring its products or services to market. Examples of operating activities include wages paid to employees, interest income, taxes paid, interest paid, and cash received from customers.

- Investing activities: Investing activities are the purchase and sale of long-term assets and other investments. Examples include the purchase of fixed assets, the purchase of stocks, lending money, and the sale of fixed assets.

- Financing activities: These activities focus on how you raise capital and pay back investors. Examples of financing activities include paying dividends to shareholders and receiving cash from issuing stock.

4. Statement of owner’s equity

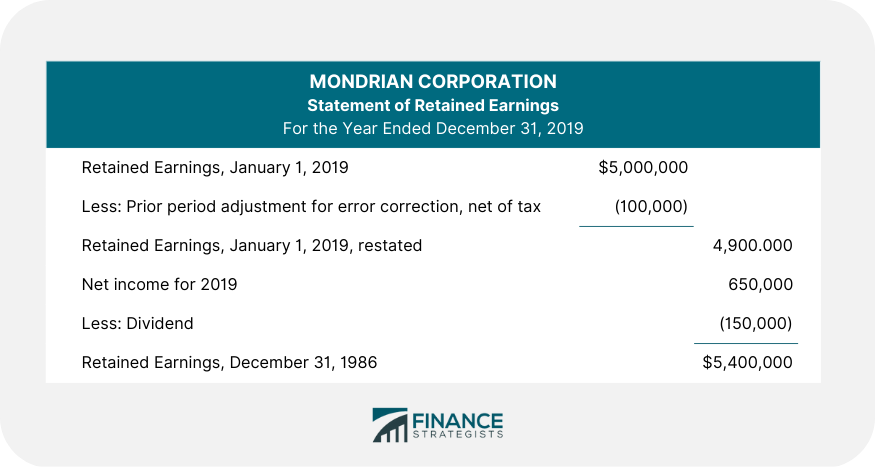

The statement of owner’s equity goes by many names: statement of retained earnings, equity statement, or statement of shareholders’ equity. The report shows changes in your business’s equity over time.

If you function as a sole proprietor, it’ll show changes to the owner’s equity. For partnerships, the statement shows changes to both partners’ equity. For corporations, the report will show how equity shares have changed among all shareholders.

You can prepare a separate equity statement or include it on your balance sheet or income statement.

Importance of a statement of owner’s equity

A statement of owner’s equity is used to better understand how the business’s profits are used, which can improve investor confidence when raising capital for your company.

What’s included in a statement of owner’s equity?

The exact format of an equity statement will vary from company to company. But generally, you’ll always include specific information.

- Beginning equity: This is the equity at the end of the last reporting period. You’ll simply roll it to the start of the next period.

- Net income: This is the amount of income the company earned in a given period.

- Dividends: The company pays dividends to shareholders from its profits as a form of distribution.

- Other comprehensive income: This includes all unrealized gains and losses that the company has not reported on the income statement.

To determine the shareholders’ equity at the end of the reporting period, you’ll typically follow this formula: beginning equity + net income – dividends +/- other comprehensive income.

Preparing financial statements for your small business

Financial statements are crucial to understanding your company’s financial health, but you cannot rely solely on one document. Together, your income statement, balance sheet, and cash flow statement will allow you to see how your business is performing over time. The income statement reports your company’s profitability, while the balance sheet tells you how liquid or solvent the business is. Your cash flow statement ties these two documents together by tracking your sources and uses of cash. You can then use a statement of owner’s equity to understand how the company is using its profits.

When preparing your financial statements, follow generally accepted accounting principles (GAAP). GAAP is the set of guidelines for how to document financial transactions and when to recognize revenue and expenses. These rules determine how to structure your financial statements and when to record transactions, depending on whether you use the cash or accrual basis of accounting. To learn more, read “Cash versus accrual accounting system.”

Conclusion

Financial statements are a crucial tool for understanding your company’s financial performance and activities. In this article, we have explored the four most important types of financial statements for small businesses, including the income statement, balance sheet, cash flow statement, and statement of owner’s equity. You can use each statement to gain an in-depth look at different aspects of your business’s financial health and make better business decisions. By preparing financial statements according to generally accepted accounting principles, you can ensure that your business is accurately and transparently represented. With these financial statements, you can stay on top of your company’s finances, identify areas of improvement, and make informed decisions that will drive your business toward greater success.