Exit Strategies: What Small Business Owners Need to Know

When starting your small business, you’re likely not thinking about how you want to sell it. Many business owners don’t think about their exit strategies until they’re ready to leave the company. But planning your exit early can help you make better business decisions, secure your financial future, and help maximize your profits.

In this article, we’ll share everything you need to know about planning your exit strategy, including why you need one, how to develop your exit plan, and common strategies.

What is an exit strategy?

Many people think an exit strategy is simply a way to end a business. But an exit strategy is a strategic plan to sell ownership in your company. It provides a roadmap for how you’ll leave your company and what will happen to the business after you’ve left.

A defined exit plan considers all stakeholders and the business’s finances and operations. It details the activities required to sell or close your company and prepares for a smooth transition.

Why planning your exit is important

Leaving a small business you built can be emotional and may feel overwhelming, but planning your exit early can make it more manageable. Consider including your strategy in your business plan to attract investors and appeal to lenders; they’ll know their money is protected if your company fails or you decide to leave.

An exit strategy can also protect your funds. If your business is doing well, it can help you maximize profits. But if it’s struggling, your plan can help minimize losses.

Benefits of having an exit strategy

Developing your exit strategy before you plan to execute it can greatly benefit your business now and when you’re ready to sell your stake in the company.

Helps You make better business decisions

You’ll have the next stage of your business in mind every time you set long-term goals. This helps you make more strategic decisions and make progress toward your objectives.

You understand your business’s finances better

When developing an exit strategy, you’ll need to keep consistent and up-to-date data about your company’s finances, which will give you a good understanding of your various revenue streams and expenses. Ultimately, you will be able to manage cash flow more efficiently, better prepare for seasonal fluctuations, and focus your marketing efforts on products or services that bring in the most revenue.

Attracts potential buyers

Many potential buyers want to purchase businesses with planned exit strategies because it shows that the owner is committed to the business’s vision and goals.

Guarantees a smooth transition

A thorough exit plan details all roles and responsibilities within your business. Because every employee and stakeholder will clearly understand their role, the transition will be easier when you move on from the company.

Your exit strategy will also highlight all the essential information your successor needs to run your company successfully. So the new investors or owners will not have to waste resources collecting that information and can hit the ground running as soon as you leave.

Common types of business exit strategies

To help you determine which exit strategy is right for you, consider the following common types.

1. Liquidation

Liquidating your business means closing the company and selling your assets as quickly as possible. The assets you sell include real estate, inventory, and equipment. Liquidation does not typically provide large profits for the business owner, so it’s often used by failing businesses to pay off their debts because you will have to pay your creditors or investors before paying yourself.

After liquidating your assets, your company will no longer exist, which will likely upset your employees because they’ll have to find new jobs.

2. Asset sale

An asset sale involves selling some or all of your business’s assets to a buyer. These assets may be physical, like equipment, land, buildings, and customers. Or, they might be intangible, like trademarks and intellectual property. Typically, value-adding assets (like real estate and equipment) will be the most profitable.

Buyers like asset sales because they can purchase what they want and leave unwanted assets with you. Your business may continue operating after the sale, and you’ll still be responsible for any outstanding liabilities. If you want to sell your entire company, an asset sale is not the right exit strategy for you.

Sellers may prefer stock sales because the taxation of asset sales is more complicated than a stock sale and may result in higher taxes.

3. Stock sale

In a stock sale, the buyer purchases stock directly from each stockholder. Your business’s legal status, name, operations, and existing contracts will remain unchanged unless otherwise specified during negotiations. Stock sales usually benefit you as a stockholder because the buyer will pay you directly. Also, the taxation of a stock sale is more straightforward versus an asset sale.

A stock sale tends to benefit the seller, while an asset sale is more beneficial to the buyer. You can learn more in our article “taxation of asset sale vs. stock sale.”

4. Merger

A merger is when two businesses combine to form a new company. After the merger, you’ll likely still be involved, so it is not a good option if you want to leave the business entirely.

There are five main types of mergers:

- Horizontal: the involved businesses are in the same industry

- Vertical: both companies are part of the same supply chain

- Conglomerate: the two businesses have nothing in common

- Market extension: both companies sell the same products or services in different markets

- Product extension: the businesses’ products complement each other

No matter which merger type you pursue, it’s crucial to ensure that the other company is a good match for your existing business. If it’s not, you may end up losing revenue instead of increasing it.

5. Acquisition

An acquisition is when one company buys another business. Typically, a larger, more prominent business will purchase a smaller one. There are two primary types of acquisitions:

- Friendly: you agree to be acquired by another company

- Hostile: you do not agree to the sale, and the other company purchases stakes in your business to purchase

If you want to exit via acquisition, it will likely be friendly because you can find a business you want to sell to.

With an acquisition, you’ll give up ownership to the buyer, so it may not be the right exit strategy for you if you want to remain involved after the sale. You may also be required to sign a non-compete agreement, meaning you could not work for or start a business similar to the one you sold.

If you want to make a large profit, an acquisition may be one of your best options. If you’re selling to a competitor or entertaining multiple bids, you may be able to drive the price up.

6. Private equity investment

A private equity investment is the acquisition of a company by a private equity firm, which invests in companies in exchange for an ownership stake. A private equity firm buys your business by purchasing shares from existing shareholders and lenders.

With a private equity investment, you will typically keep running the business and retain control. This makes it a great exit strategy if you want to continue in a leadership role while gaining access to additional resources. It’s also likely that the private equity firm has experience with companies similar to yours and can help you grow the business.

7. Initial public offering

An initial public offering (IPO), or “going public,” means your business begins selling stock publicly on the stock market. Your company will go from a private company to a publicly traded one, and you will give up part of your ownership to stockholders from the general public.

You may continue running the business after the IPO, but you’ll lose flexibility in managing the company because your new shareholders will have a say in the business’s direction.

Many businesses go through a high-growth period after an IPO because they secure more funds to pay off debt or expand their offerings.

Going public is typically a long, tedious, and expensive process. You’ll need to find an investment bank, collect financial information, register with the U.S. Securities and Exchange Commission (SEC), and determine a stock price. Because of the time and expense required, an IPO may be challenging for small businesses.

8. Sale to a strategic buyer

With a sale to a strategic buyer (also called a trade sale), a buyer purchases your business for their own strategic interest, such as for market growth or access to trade secrets. Since the buyer has identified the strategic benefits of your company, they’re likely willing to pay a great deal, and you could gain a large profit from the sale. You may also be able to stay involved in the business and further benefit financially through a salary, shares, and other benefits.

9. Family succession

With a family succession or legacy exit plan, you sell the business to a child or other family member. This exit strategy is appealing if your business is profitable and you want to keep the company’s legacy in the family.

The person you sell the business to likely has an intimate knowledge of the company and how to run it, especially because you can spend years preparing them to transition into a leadership role. But it’s important to remember that there might not be someone in your family capable of taking on ownership and continuing to run the business. And it’s possible that you could blur the line between your professional and personal relationship with the buyer, which could cause unnecessary financial or emotional stress for your family.

With a legacy exit, you will probably retain a close connection to the company and may choose to stay on as an advisor or consultant.

10. Employee stock ownership plan

An employee stock ownership plan (ESOP) means selling all or a portion of the business to your employees. You transfer ownership by creating an employee stock ownership trust. Ultimately, the trust can buy the company at its fair market value. Your employees don’t have to come up with the funds necessary to purchase your business. Instead, you’ll give your staff shares of stock as an employment benefit.

ESOPs are difficult to structure because they’re subject to Employee Retirement Income Security Act (ERISA) regulations. As a small business owner, consider finding an advisor with extensive ESOP experience to help.

An ESOP may be appealing because your company will likely continue to operate as usual after your exit. You’re also likely to remain involved with the business.

11. Management buyout

With a management buyout, key members of your management team purchase the business. They’ll need to have the means necessary to buy an ownership stake or be able to borrow enough to do so.

Because your management team is already intimately familiar with your business, they should be well-equipped to continue managing it. And the transition process will likely be smoother and more straightforward than selling to a third party.

How to plan an exit strategy

Planning your exit requires effort and time. You should also update your exit strategy as your company grows and your goals change. To develop your strategy, take the following steps.

a. Create a clear vision of your business in the future

First, define what success looks like for you and your company. For you, success may be running a profitable company, gaining recognition, or having the ability to pass on leadership to someone else. Knowing how you define success will help ensure that you and your team are all working toward the same goal.

b. Determine who will be involved

It’s crucial to decide who will be involved in the sale of the business when the time comes. Decide if you will take an active role in the sales process or if you will let professionals, like a broker, handle the details. If you choose to handle the sale yourself, read our article “How to sell a small business without a broker.”

c. Prepare your finances

By preparing your personal and professional finances, you’ll better understand your expenses, assets, liabilities, and business performance. This can help you seek out the best buyer and negotiate a beneficial deal when the time comes to sell your company. If you have investors, preparing your finances is essential, so they know how they will be repaid upon exit.

d. Consider your options

As mentioned earlier, there are many different types of exit strategies you can pursue. The best plan for you depends on how you envision your life after the exit and whether you want to remain involved in the business. You might want to talk to a business attorney, financial advisor, or business mentor to help make the right decision.

e. Choose new leadership

Make sure that you have documented operations in place to easily transition leadership responsibilities to the buyer when you exit the business. You can also begin training existing staff members to ensure the buyer has the support they need for a smooth transition.

How to determine which exit strategy is best for your business

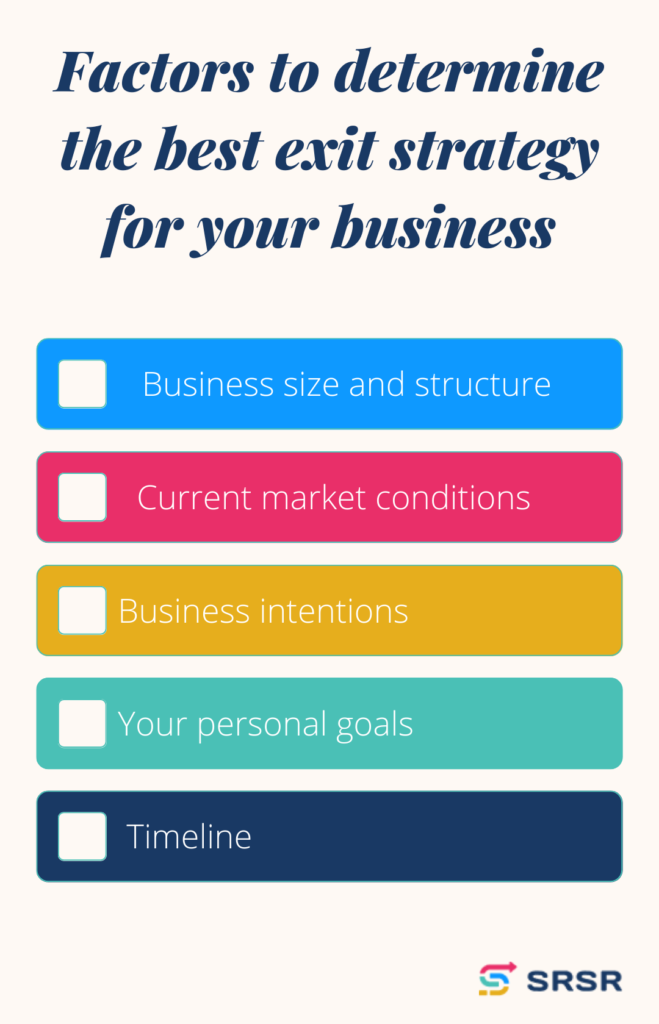

With so many different strategies available, it can be difficult to determine which option is best for you and your company. But there are several factors to consider to help you make the right decision.

- Business size and structure: If you are a sole proprietor, you can focus more on your personal goals and choose an exit strategy that maximizes your profits. But if your business is a partnership or corporation, you also have to consider the interests of the other stakeholders involved.

- Current market conditions: It’s crucial to consider the current supply and demand for your products or services because that will help you determine whether there will be many potential buyers for your business or only a few.

- Business intentions: Consider whether your business will continue operating after you’ve left or if you want it dissolved completely. You will also need to decide if you wish to remain involved.

- Your personal goals: Determine whether it’s more important to maximize your profits or leave a legacy. If you want to maximize your earnings, you might consider a trade sale or acquisition. But if you prefer to leave a legacy, then you may want to consider a succession plan.

- Timeline: Determine when you intend to sell your business, so you know how much time you have to prepare your company and attract the best possible buyer.

Are your employees prepared for your exit strategy?

Having an exit plan in place is crucial to ensure you have outlined a clear chain of command to follow when you’ve left the business. This will help foster a smooth transition when the new owner takes over. To help ensure a successful transition, you’ll need to prepare your employees for the sale of your company. To learn more about preparing your staff, read our article “How to prepare employees for transition after selling the business.”