Due diligence is invaluable for any investor or business making a significant decision. It gives insight into the strengths, weaknesses, and other potential investment issues and its growth prospects to ensure a successful acquisition.

Due diligence can also unveil crucial information that may change your opinion about a business deal. So, what does this process involve, and how can you conduct effective and thorough due diligence?

Let’s find out.

What is Due Diligence?

Due diligence is a thorough investigation of the target company or investment opportunity to uncover any potential risks, liabilities, and opportunities that may be present.

This process can include examining financials, legal documents, human resources policies, operational procedures, environmental regulations, compliance, and other aspects related to the transaction. By conducting due diligence, you can make more informed decisions with greater confidence in the results.

Due diligence aims to provide additional insight into the business or investment before committing funds or resources that can help reduce risk and increase profits by preventing costly mistakes.

Advantages of Due Diligence

Due diligence gives you a more detailed understanding of the potential investment so you can confirm whether proceeding with the acquisition is the best move. You’ll have the chance to assess critical information, such as the legal, financial, and commercial standing to get an idea of how the business works.

Identifying Opportunities

Due diligence can help identify new opportunities you may have yet to consider.

You could uncover data or insights on customer preferences and trends, financial performance, market dynamics, and other factors that could create an opportunity for growth or increased profitability.

By taking the time to investigate a potential transaction more thoroughly, you can make decisions with greater confidence in the long-term success of your investments.

Saving Time and Money

Conducting due diligence can help save significant amounts of time and money by preventing costly mistakes in the future.

If you identify risks early on, there is less chance of having to backtrack later, which would take additional resources away from the primary goal – making profitable investments or running successful business operations.

Increasing Efficiency

By conducting thorough due diligence, you can maximize efficiency because you will better understand the business while executing any transaction or operation-related activity within the new organization.

You can move forward quickly without wasting valuable resources searching for solutions as you go along, which would only slow down progress.

Reducing Legal Risk

An essential part of due diligence is examining the legal risk of any potential investment decision or business agreement.

Understanding all relevant laws about the deal at hand ensures everyone involved acts appropriately, which minimizes your exposure to legal risk and regulatory penalties.

Enhancing Compliance Standards

Conducting proper due diligence increases overall compliance standards within an organization. It ensures the company operates according to industry best practices guidelines established by governing bodies responsible for these regulations.

Furthermore, internal policies and procedure manuals created during this process provide clear guidance for your employees, minimizing the chances of significant missteps while going about daily routines.

Types of Due Diligence

Hard Due Diligence

Hard due diligence is an extensive and comprehensive analysis of the target company or investment opportunity focusing on financials, legal documents, operational procedures, and other aspects related to the transaction.

This type of investigation provides a detailed look at all facets of the organization to uncover potential risks or liabilities before committing funds or resources.

Soft Due Diligence

Soft due diligence examines the overall health and viability of a business opportunity, including its potential customer base, market trends, competitive landscape, and other factors that could indicate whether it would make a successful venture in the long term.

It also involves looking at existing management strategies and policies within the company to determine if they are sufficient for meeting future goals should you decide to move forward with your decision.

Financial Due Diligence

Financial due diligence looks closely at current and past financial statements associated with a particular investment opportunity to gain insight into how it has performed over time and what kind of returns you can expect going forward.

This process typically includes evaluating cash flow projections, income statement analysis, balance sheet review, debt structure, etc., providing valuable insights into how viable this specific offering is from various perspectives.

Legal Due Diligence

Legal due diligence focuses on examining agreements, contracts, licenses, etc., signed between parties so you can understand what rights and obligations each one holds.

This type of investigation helps uncover potential liabilities, such as violations against regulatory laws, consumer protection statutes, and environmental regulations, which the other party must deal with before engaging further.

Human Resources (HR) Due Diligence

HR due diligence analyzes personnel matters such as staffing levels, compensation packages, benefits policies, hiring practices, disciplinary actions, employee retention programs, training opportunities, union negotiation requirements, and compliance standards.

All these factors play an important role when assessing the risk associated with new investments hence why a thorough review is necessary to ensure everything runs smoothly after acquisition.

How to Perform Due Diligence for stocks, M&A, etc

Step 1: Determine the Objectives

The first step in any due diligence process is identifying the review’s objectives. You should define the scope of the investigation and set measurable goals.

When you outline objectives at the start, all involved have a clear path to follow in each stage.

Step 2: Collect Relevant Documents and Information

Once the objectives are clear, the next step is gathering relevant information and documents related to the target company or investment opportunity.

Critical documents typically include financial statements, legal documents, operational procedures, and other materials that provide insight into how successful this venture could be in the long run.

Step 3: Analyze Financial Reports and Data

Once you acquire the relevant information, it is time to analyze the financial data and reports. Typically, you examine current balance sheets and income statements to look for potential red flags, such as debt levels or accounts receivable problems that could indicate financial distress or mismanagement.

It would be best to analyze cash flow projections to gauge how much liquidity the organization can access at any time.

Step 4: Assess Quality Control Standards and Operational Performance

After reviewing the financial documents, it is essential to dig deeper into operations to determine whether the organization is running efficiently and if any quality control standards are necessary for successful long-term performance.

Step 5: Evaluate Growth Potential and Market Attractiveness

Another critical element of due diligence is evaluating a potential investment’s market attractiveness and growth prospects.

Key actions include examining customer preferences and trends, competing products or services, and pricing strategies better to understand this opportunity’s viability from a business perspective.

Step 6: Check Regulatory and Legal Issues

Assessing regulatory and legal compliance standards is essential in due diligence for stocks, mergers, and acquisitions. There could also be local laws or regulations related to employment contracts, environmental compliance standards, health & safety rules, intellectual property rights protection policies, anti-trust concerns, etc.

You should thoroughly understand all relevant legal matters before entering into an agreement. Doing this mitigates the risk of violations, which are costly and time-consuming to rectify.

Step 7: Evaluate Market Conditions and Competition

Assessing a particular industry’s competitive landscape and market conditions involves researching existing products or services, understanding customer preferences and trends, pricing strategies, potential risks and opportunities, and more.

If competitors offer reasonable or competitive prices and high customer loyalty, the chances of success are much lower than if those variables were vice versa. Therefore, conducting a thorough investigation into this area provides the valuable insight you need to make informed decisions, ultimately resulting in better outcomes.

Step 8: Assess Corporate Governance

Assessing the corporate governance of the target company or investment includes studying the board of directors structure, administrative management policies, shareholder rights and privileges, company bylaws, and decision-making processes.

It helps you understand how well-organized the organization is and if it is making decisions that are in the best interest of its shareholders.

Step 9: Understand the Management Structure and Performance

Conducting a thorough management structure and performance analysis is another critical step in due diligence for stocks & M&A deals.

Understanding the management structure allows you to make more informed decisions about pursuing an investment opportunity and provides valuable insights into how well the organization will likely perform in the future.

Step 10: Analyze Cash Flow and Liquidity Risk

Understanding a company’s current cash flow levels and ability to generate future cash flows is essential. This analysis should assess operating activities (net income) and investing activities (cash used in capital expenditures).

It is also best to consider the liquidity risk, which involves analyzing the company’s debt structure, working capital management strategies, credit ratings, etc.

Step 11: Understand the Tax Implications

Besides the legal risks, you should also evaluate what kind of tax implications you might face after the transaction, whether personal or corporate taxes, etc. Certain elements such as depreciation, amortization, write-offs, reporting requirements, and transfer pricing restrictions could majorly impact the financial picture, so your due diligence process should account for these factors.

How Does Due Diligence Impact Business Transactions and Investments

Due diligence is an essential part of any business transaction or investment. A thorough understanding of this process can distinguish between success and failure.

A well-executed due diligence review helps to identify potential risks while offering insights into how best to mitigate those risks. It clarifies the actual value of a business opportunity and its possible future growth trajectory.

You can leverage this information when deciding whether to commit resources to ensure you get the most out of your investment.

Furthermore, due diligence allows you to understand the type of commitments that may be necessary regarding capital investments, personnel costs, compliance obligations, etc. so that you can accurately budget for these expenses ahead of time.

Due Diligence Checklist

Creating a practical checklist is one of the most critical steps in conducting a successful due diligence review. This document should provide proper guidance on what items to include and tips for developing and executing a thorough investigation.

The checklist should cover financial data analysis, operational reviews, legal document evaluation, market research, and competitive landscape assessments.

Financial data analysis can involve examining current balance sheets, income statements, and cash flow projections to look for red flags indicating financial distress and gauge the organization’s liquidity.

Operational reviews are also critical since they explain how effectively the business utilizes resources and whether operations are running efficiently. This typically includes looking at staffing levels, customer service standards, and policies related to inventory management to gauge the overall performance trends.

During due diligence, you must examine legal documents closely to understand exactly what rights each party holds under various agreements, contracts, and licenses. Furthermore, this step helps uncover potential liabilities arising from violations.

Market research is another crucial component when assessing the risk associated with new investments. It provides greater visibility into customer demand trends, product pricing strategies, competitive forces influencing the industry, etc.

All these factors are essential when deciding where to allocate funds. A thorough review is necessary to ensure everything runs smoothly once you reach the final agreement.

Questions to Ask While Conducting a Due Diligence Review

It’s also advisable to conduct competitive landscape assessments to determine where the company stands compared to its peers.

- Are services offered competitively priced?

- Are there any unique selling points that help stand out from the crowd?

- What changes do you need to remain competitive going forward?

The answers to all these questions will be apparent during this portion of the investigation, thus why it’s essential to include them. You should also evaluate the customer service reviews well since they provide insight into how well the organization responds to customer needs.

- Are they providing timely, efficient solutions for any issues arising?

- Are they friendly and knowledgeable, giving customers reasons to return to build a loyalty base?

All these factors play a role when deciding if a company is the right investment opportunity, so you must account for them during due diligence.

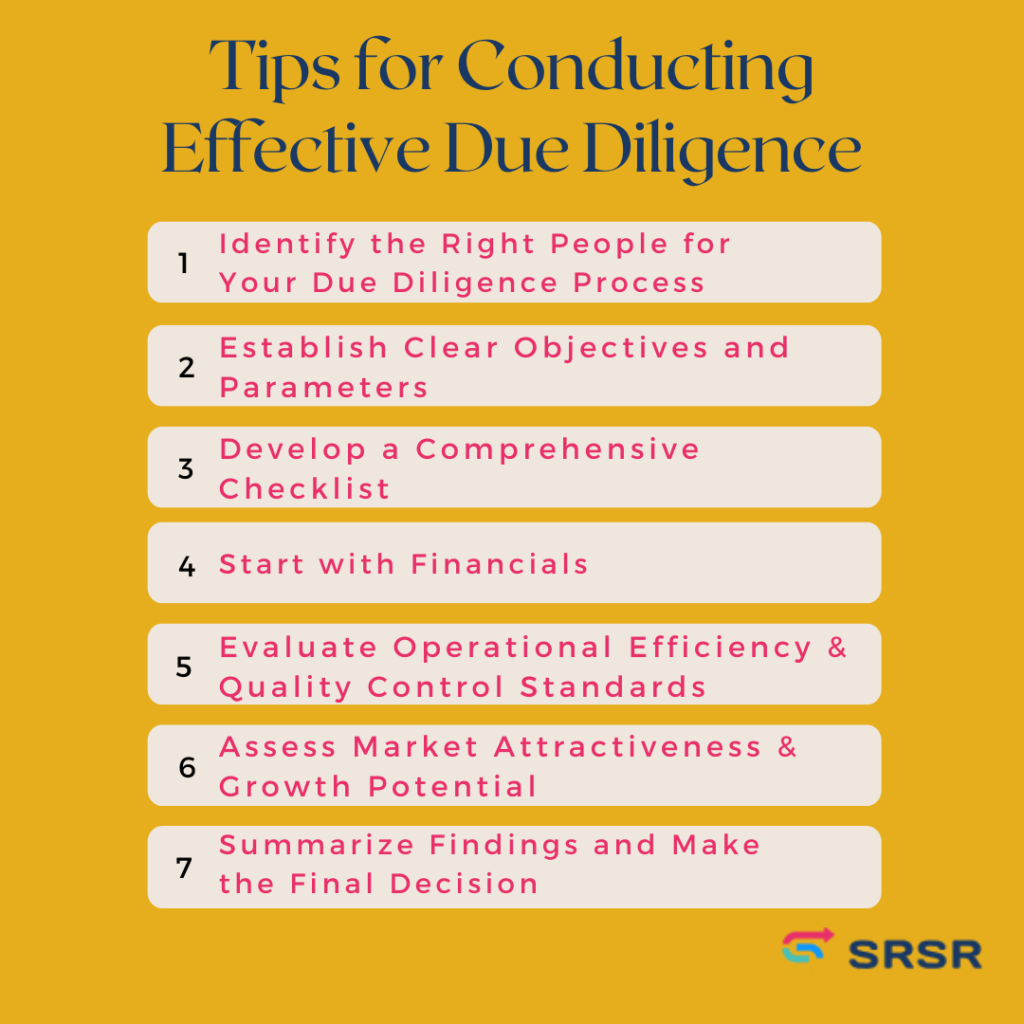

Tips on How Businesses and Investors Can Conduct Effective Due Diligence

Identify the Right People for Your Due Diligence Process

One of the first steps in conducting effective due diligence is identifying and recruiting the right team members. You should look for individuals with expertise, experience, and knowledge about the specific area you plan to examine.

Having someone on your team who can act as an unbiased third-party observer is also beneficial. This individual can monitor and advise on any conflicts of interest. Meanwhile, internal team members can remain focused on their roles and responsibilities.

Establish Clear Objectives and Parameters

Before beginning a due diligence review, it is best to define clear objectives, so everyone knows what they are working towards. Part of this includes setting measurable goals, such as timeline benchmarks or success metrics, that you can use to quantify progress over time.

It is also essential to determine any limitations about the scope of the investigation or any areas deemed off-limits that you need to exclude from the inquiry.

Develop a Comprehensive Checklist

Once parameters are clear, the next step involves creating a comprehensive checklist to guide the process.

It would help if you addressed every aspect of the potential transaction. Failure to do so could lead to missed opportunities and overlooked risks, which could spell disaster.

Start with Financials

When assessing the risks associated with new investments, the best place to begin is always financial statements. These documents provide the most accurate picture of the company’s current standing, how funds get allocated across departments, and how efficiently operations run.

Ensure you review all relevant data you gather here to detect any red flags before moving on to other elements of the process.

Evaluate Operational Efficiency & Quality Control Standards

After reviewing financial documents, dig deeper to evaluate the organization’s overall efficiency.

The below-the-surface analysis involves looking at staffing levels, employee compensation packages, benefits, policies, hiring practices, disciplinary actions, training programs, compliance standards, etc.

Assess Market Attractiveness & Growth Potential

Another critical element due diligence process involves evaluating the attractiveness of the market opportunities and the potential growth trajectory.

This research takes a deep dive into the competitive landscape to understand better the company’s performance against competitors to see where the chances of coming out the top are.

Summarize Findings and Make the Final Decision

After you complete all steps, it’s time to summarize the main findings and present them to the key decision-makers who will ultimately decide whether to invest. This stage involves finalizing the risks associated with the transaction and weighing the pros and cons based on the information you gathered throughout the process.