Starting a business can feel like learning how to ice skate. At some point, you’re going to fall, and you’re going to get a little bruised, but if you stick with it, eventually, you’ll be soaring.

Much like ice skating, there are certain metaphorical walls you can cling to support you while you learn. A business budget is one of those walls. Having a business budget is crucial for long-term success. Not only does it help you avoid budget deficits, but it also helps you set up a sustainable and growing company.

In this article, we’ll go over the what, why, and how of business budget planning. Let’s dive in.

What is a business budget plan?

A business budget plan is a financial outline of your expected revenue and expenses over a specific period of time. Most business budgets will cover a year; however, if you are just starting a business, it can be helpful to create a longer-term budget plan. A long-term budget plan may detail your financial goals for two to ten years.

Your budget plan should address all anticipated costs of your business. This includes but is not limited to:

- Rent

- Supplies

- Marketing costs

- Salaries

- Insurance or licensure costs

In addition, while business budget planning, you should address revenue sources, unexpected costs, and cash flow projections. The purpose of creating such a detailed plan is to help you ensure your business’s financial viability. Longer-term budget plans serve the purpose of helping you establish long-term goals.

With that in mind, a longer-term budget plan should be more flexible than your annual budget plan. They both should also be reviewed consistently to confirm that the plans remain relevant and that you are on track for long-term success.

Beyond that, a budget plan can help you establish a metric to develop realistic financial goals and support you in making informed business decisions. In the early days of a business, budget planning can help you secure investments and increase your chances of long-term success.

Why is it important to plan a business budget?

Just like a personal budget, a business budget can help you confirm that you can afford to pay the bills and that you’re in the black at the end of the month, quarter, or year. Creating a business budget is an essential part of building a business. Budget plans are important for sustaining your business, and they help give you more control over your finances. Without a business budget, your business is at risk of financial oversights or other consequences that could cost you your business.

Long-term budget plans are important for helping you better manage your business’s long-term finances. Creating a long-term budget will help to set you up for long-term success. They can be a helpful benchmark to check your expenses against as you grow and help you ascertain that all expenses are relevant and aligned with your short and long-term business goals.

Benefits of business budget planning

1. Financial control

Having a business budget plan can help you establish guidelines and set limits for spending. Being able to track your expenses carefully gives you greater financial control over your business.

Financial control can help you prevent extemporaneous spending that doesn’t directly support short and long-term goals. It can also help you ensure your expenses are being managed in a way that maximizes profits.

Additionally, it can prevent you from incurring fines or penalties if your business falls within a sector that needs to meet regulatory requirements. For example, if you start a nonprofit, having a business budget plan helps you comply with nonprofit budget regulations.

2. Planning for the future

True business success isn’t spontaneous. It requires detailed and realistic planning in support of your goals. Think of a business budget as a financial roadmap to success.

A business budget plan can help you allocate resources, identify priorities, and provide you with important information for making financial decisions. Using a short-term and a long-term financial plan in tandem, you can determine if your short-term investments are keeping you on track for your long-term goals.

A budget plan also allows you to track and understand key financial metrics beyond what is in your business bank account. You can plan for any unforeseen costs as your business grows.

3. Resource distribution

By having a detailed account of your financial position, you can make the most effective decisions for resource distribution. You can ensure that you have the appropriate funding available to support essential activities or investments. A budget plan can also help you prioritize investing in certain areas over others to further your business goals.

Let’s say you have found social media marketing to be the most effective marketing channel, so you want to allocate a larger portion of your budget to social media advertising. By having a detailed budget plan, you will be able to:

- Understand how much you spent in previous years

- Create a realistic budget for the campaign

- Identify key areas to cut back to meet the financial demand of a larger social media marketing budget

- More easily track the return on investment of that financial expenditure

4. Funding

When securing investors or lenders, a business budget plan is the first step in demonstrating your ability to commit to financial discipline. Furthermore, a business budget plan provides transparency and accountability. This helps to build investor confidence, especially in the early stages of building a business.

5. Performance monitoring

Long-term and short-term budget plans allow you to gauge your company’s performance. This will allow you to then track your business performance against projected results. By having a detailed record of your costs and revenue, you will be able to better prepare for the years ahead, correct any variances, and easily understand where you need to cut back or allocate more funding.

Five steps to business budget planning

Now that you know the importance of having a business budget, let’s get into the creation process. Your business plan should be as comprehensive as possible. At this point, it’s important to note that there are several types and methods for building a budget. The following steps are a general outline of the essential steps that can be applied to all types of budgets

1. Set financial goals

Setting financial goals is the first crucial step in creating a business plan. This will help you determine the appropriate amount of spending for your business.

Long-term financial goals will focus on helping you achieve sustainable growth and profitability over several years. Some examples may be:

- Increasing market shares

- Developing new products

- Expanding into new markets

In contrast, short-term financial goals focus on specific financial objectives over a short period. Examples include:

- Increasing profit margins

- Improving inventory turnover rates

- Increasing customer conversion rates

By setting both short-term and long-term financial goals, you can set yourself up to achieve immediate financial success and longevity.

2. Collect information

The second step in building a business budget plan is to collect relevant information. If you’re just starting your business, this will look different than if you already have an established business.

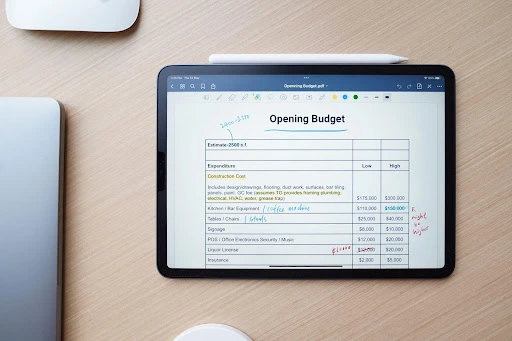

A starting business’s business plan should include:

- Start-up costs: This should be a comprehensive tabulation of any expenses you will incur before launching. This includes legal fees, permits, down payments, marketing, equipment, etc.

- Operating expenses: These will be ongoing expenses like wages, utilities, insurance, and rent.

- Revenue projections: This is how much you expect to make in the first year of operation and should be based on market research and sales forecasts.

- Cash flow: This is an estimate of the amount of cash you will receive each month based on your revenue projections and anticipated expenses.

- Emergency fund: This is a set amount that you have set aside for unexpected issues or expenses.

- Sales pricing strategy: This thorough outline describes how you will optimize sales. This will include your cost of goods and services based on market research, how you will manage customer relationships, gather leads, and so forth.

- Tax considerations: This includes the tax implications of your business structure and operations and identifies any tax breaks or incentives that may be available.

If your business is already established, you will need to include financial statements from previous years. These will give you a good idea of sales, expenses, and cash flow. From there, you can make predictions and projections for the upcoming business year.

3. Create a budget worksheet

Once you have collected your information, it’s time to put it into a spreadsheet. Several budgeting software products can help you do this, but Excel or Google Sheets can work as well.

This worksheet should detail all the information you collected in the previous step. An annual budget worksheet should break this information down by month or quarter. For longer-term budgets, you may break down your budget into annual or biannual segments. This will allow you to visualize and plan for success throughout the year.

4. Estimate revenue and expenses

You can estimate expenses in several ways, depending on the type of budget you’re building.

- Static estimates: A static estimate looks at your historical financial data to create a revenue and expense estimate based on the percentage of increases or decreases. This type of budget is best used by small and nonprofit organizations because these institutions generally work with a fixed amount of money.

Because this requires previous financial data, this is not the best method for businesses that are just starting. That being said, having a static budget adjusted in a way that demonstrates your performance goals can be a useful tool to have on hand as it offers an unwavering guide for any given time.

- Zero-based estimates: This cost/revenue analysis begins each line of your budget sheet from zero and builds a new budget based on the current market climate. For small and medium-sized businesses, a zero-based budget is a great option as it will force you to reassess your assets each year.

- Variance analysis estimate: A variance-based estimate requires that you tabulate actual and expected values for each item. This can be helpful to budding businesses that are looking to reduce costs and increase efficiency.

- Perfomance-based estimate: A performance-based budget also relies on historical financial data to determine the input and output of goods and services. This type of budget can be used to motivate higher performance in employees.

5. Balance, monitor, and adjust

The final step in creating a budget is to balance it. This means that you adjust your estimates as needed to make certain that your expenses are taken care of, and you’re on track to meet your goals. Balancing your budget throughout the year will require that you are constantly monitoring and adjusting as needed.

Final thoughts on business budget planning

Building a business can feel overwhelming at times, but having a business budget plan can help alleviate some of the financial stress. A starting business budget plan is crucial in helping you be prepared for the future of your business and establish healthy financial habits. By following these steps, you can build a comprehensive business budget that supports your business aspirations.

Are you interested in learning more about business budgeting? You’ve come to the right place! We are dedicated to bringing high-quality resources to small business owners like you.